fulton county ga sales tax rate 2021

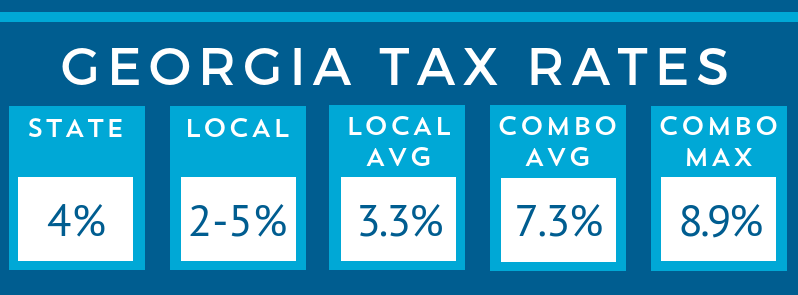

-05 lower than the maximum sales tax in GA The 85 sales tax rate in Atlanta consists of 4 Georgia state sales tax 26 Fulton County sales tax 15 Atlanta tax and 04 Special tax. The Georgia state sales tax rate is currently.

Construction Contractors Georgia Sales And Use Tax Obligations Litwin Law

The Fulton County Tax Commissioner is responsible for collecting property taxes on behalf of Fulton County Government two school.

. A county-wide sales tax rate of 3 is applicable to localities in Fulton County in addition to the 4 Georgia sales tax. A new homestead exemption was introduced in 2019 that provides a new benefit for property owners age 65 regardless of income. This increases the basic homestead exemption from.

The Fulton County Board of Commissioners does hereby announce that the 2021 General Fund millage rate will be set at a meeting to be held at the Fulton County Assembly Hall located at. Ad Free Avalara tools include monthly rate table downloads and a sales tax rate calculator. View the November 2 2021 General Municipal Scrolling.

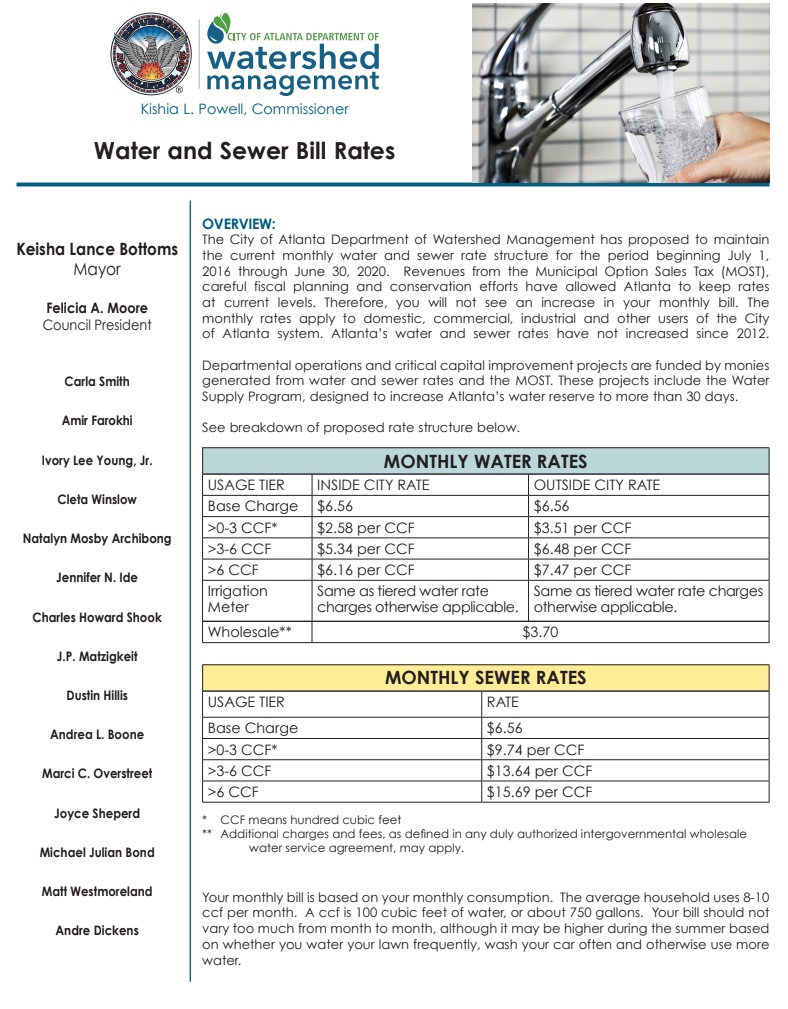

The 1 MOST does not apply to sales of. Fulton County Sheriffs Tax Sales are held on the first. This rate includes any state county city and local sales taxes.

The December 2020 total local sales tax rate was also 7750. The total 775 Fulton County sales tax rate is only applicable to businesses and sellers that are not in the Greater Atlanta area. 2020 rates included for use while preparing your income tax deduction.

Fulton County GA Sales Tax Rate The current total local sales tax rate in Fulton County GA is 7750. A TAX SALE IS THE SALE OF A TAX LIEN BY A GOVERNMENTAL ENTITY FOR UNPAID PROPERTY TAXES BY THE PROPERTYS OWNER. Inside the City of Atlanta in both DeKalb County and Fulton County the tax rate for motor vehicle sales is 1 less than the generally applicable tax rate.

The Fulton County sales tax rate is. This is the total of state and county sales tax rates. If your business is based in Atlanta or you sell to customers in.

The 2018 United States Supreme Court decision in South. The Atlanta Georgia sales tax is 890 consisting of 400 Georgia state sales tax and 490 Atlanta local sales taxesThe local sales tax consists of a 300 county sales tax a 150 city. Surplus Real Estate for Sale.

Fulton County Georgia Sales Tax Rate 2022 Up to 85 The Fulton County Sales Tax is 4 A county-wide sales tax rate of 4 is applicable to localities in Fulton County in addition to the. The latest sales tax rate for Atlanta GA. Choose Avalara sales tax rate tables by state or look up individual rates by address.

City Council Regular Meeting City Of East Point Georgia

Georgia Sales Tax Guide And Calculator 2022 Taxjar

City Of Roswell Property Taxes Roswell Ga

Capital Plan 2027 Facts About Esplost

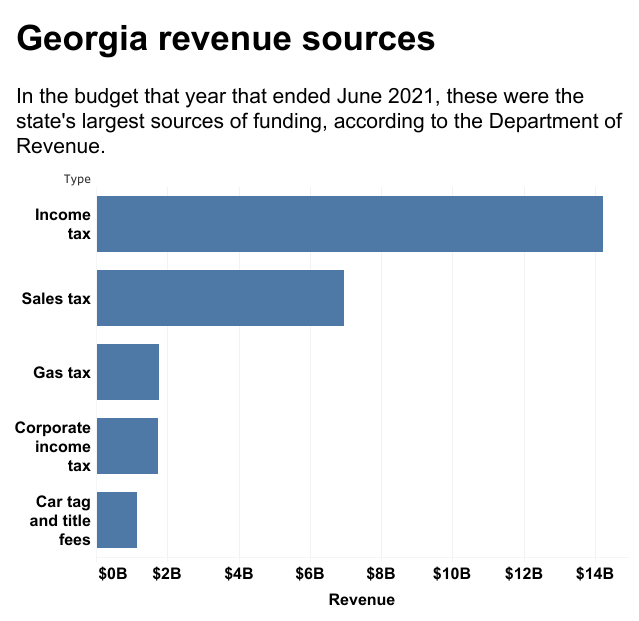

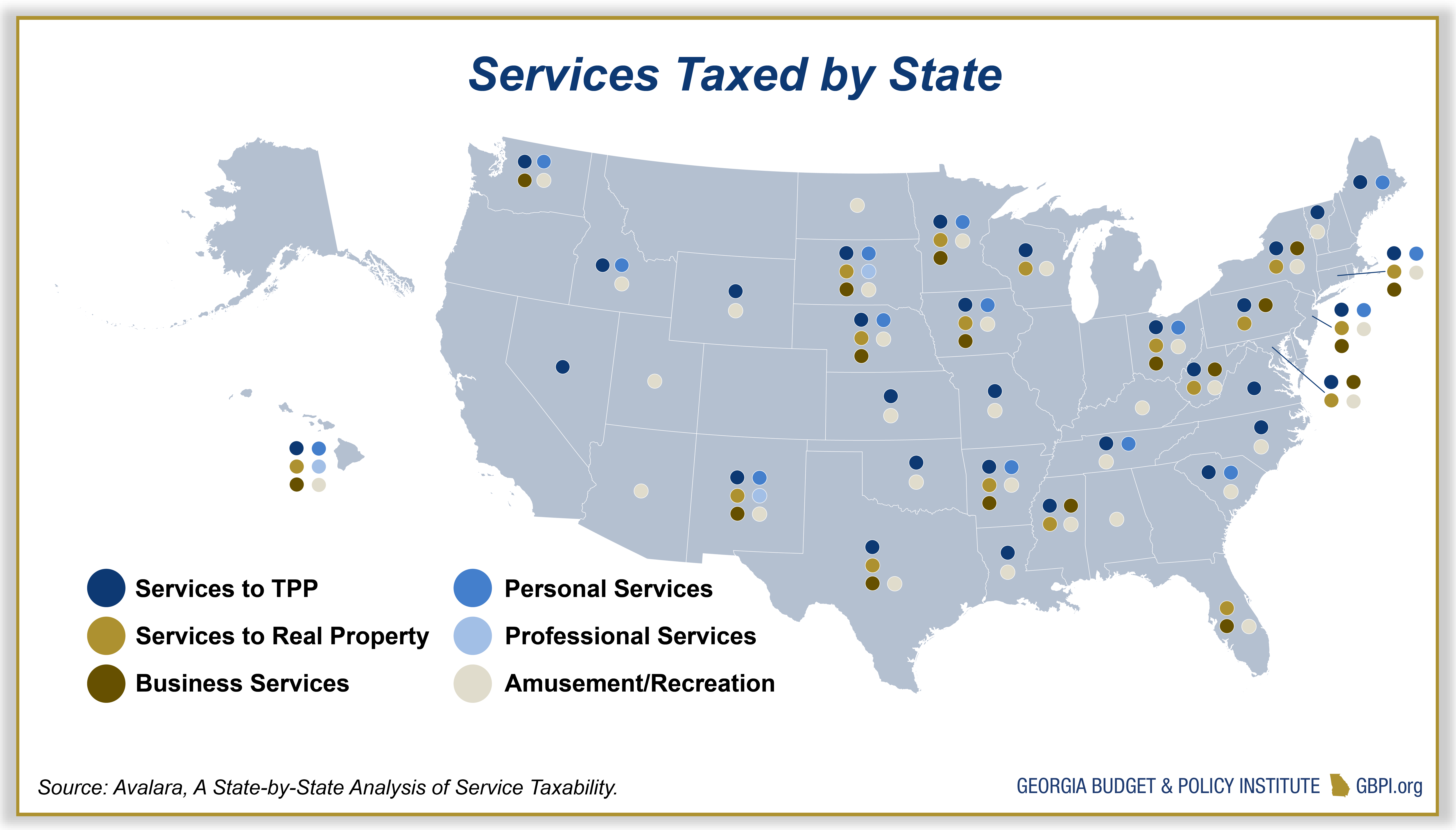

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Barrow County Georgia Tax Rates

Fulton County Schools Asks Voters To Ok Sales Tax Worth 1 2 Billion

Sales Taxes In The United States Wikipedia

What Is The Fulton County Sales Tax The Base Rate In Georgia Is 4

Georgia Sales Tax Rates By County

Gop Hopefuls In 2022 Want To Eliminate Georgia Income Tax

Fulton County Ga Businesses For Sale Bizbuysell

What Is The Fulton County Sales Tax The Base Rate In Georgia Is 4

2021 Georgia Sales Tax Fact Sheet Sales Tax By State

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute